Discover the new mobile dApp for HLiquity by blokk. Explore decentralized borrowing & lending on Hedera with HLiquity’s features and user-friendly interface.

blokk is excited to present a new mobile decentralized application (dApp) designed to enhance the accessibility and convenience of the HLiquity protocol on Hedera. Leveraging our expertise in blockchain technology, we have developed this dApp to offer users a seamless and mobile-friendly experience for interacting with HLiquity’s (www.hliquity.org) decentralized lending protocol.

Our mobile dApp empowers users to manage their loans, deposits, and collateral directly from their smartphones, ensuring they can access HLiquity’s features anytime, anywhere. By providing a user-friendly interface and intuitive navigation, we aim to make decentralized finance (DeFi) more accessible to a broader audience as it is one of the first DeFi projects on Hedera.

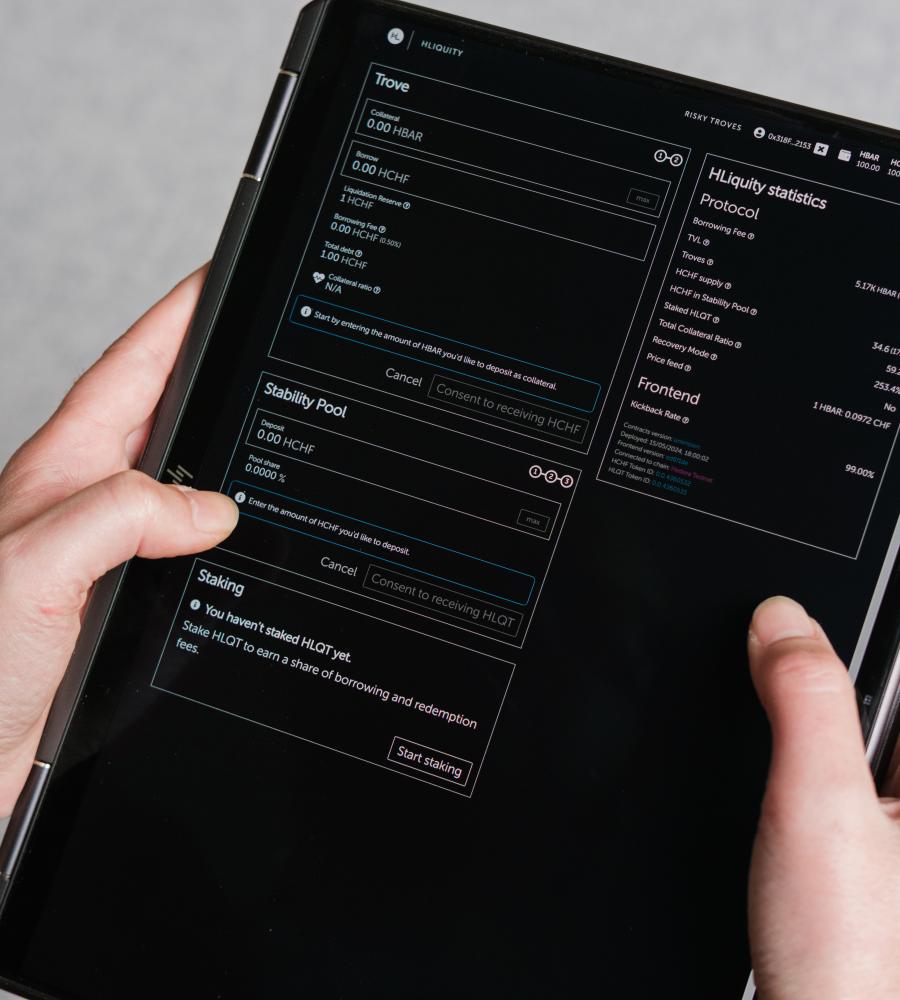

Real time loan management: Monitor and manage your loans and collateral with ease.

Secure transactions: Enjoy the same level of security and decentralization offered by the HLiquity protocol.

Optimized Liquity frontend: Delivering a fast transaction experience and showcasing blokk's Hedera expertise.

The first Liquity frontend on Hedera blockchain: HLiquity is the pioneer in bringing DeFi, the Liquity frontend to the Hedera network.

Intuitive UI: The user interface has been designed to ensure ease of use and seamless interaction.

With this dApp, we are committed to bringing the power of DeFi to the fingertips of Hedera users, making financial management simpler and more efficient.

HLiquity is a decentralized, non-custodial lending protocol that allows users to borrow funds without interest. The system is based on using HBAR, the native cryptocurrency of the Hedera network, as collateral. Loans are issued in HCHF, a stablecoin pegged to the Swiss Franc (CHF), ensuring stability and minimizing volatility. Fore more information about, please read the documentation at https://docs.hliquity.org/

Borrowing and repayment

Users deposit HBAR into the HLiquity system to receive loans in HCHF. The minimum collateralization ratio required is 110%, meaning the value of the deposited HBAR must be at least 110% of the loan value. A high collateral protects the system from fluctuations in the value of HBAR.

Repayment is straightforward: users can repay their loan in HCHF at any time to reclaim their collateral. There are no interest charges, making it an attractive option for borrowers.

Liquidation and collateral management

If the value of the collateral falls below the required ratio, the system automatically liquidates the collateral to maintain stability. Liquidation involves selling the collateral to cover the loan, ensuring the protocol remains solvent.

A Stability Pool funded by HCHF depositors supports the system. These depositors earn HLQT token rewards from liquidation events and contribute to the protocol's resilience.

HLiquity protocol

The protocol operates without any governance mechanisms, meaning it is entirely automated and immutable. This ensures trust and reliability, as no central authority can alter the rules or manipulate the system.

Stability Pool

The Stability Pool is essential for maintaining HLiquity's health. Users deposit HCHF into the pool, which is used to cover under-collateralized loans. In return, depositors receive rewards from liquidation events, incentivizing them to support the system.

Decentralization and security

HLiquity leverages the Hedera network's security and decentralization. Hedera's consensus mechanism ensures high throughput and low transaction costs, making it an ideal platform for HLiquity's operations.

Interest-free loans

One of HLiquity's main attractions is its zero-interest loans. This feature is particularly beneficial for users seeking liquidity without incurring the costs associated with traditional loans.

Efficient capital utilization

Users can leverage their HBAR holdings without selling them, allowing them to retain exposure to potential price appreciation while accessing funds for other uses.

Stability through HCHF

HCHF, pegged to the Swiss Franc, provides stability in the volatile cryptocurrency market. This makes it a reliable option for users seeking to avoid volatility while borrowing or saving.

Financial flexibility

HLiquity provides immediate liquidity, making it useful for various financial needs such as investment opportunities, covering unexpected expenses, or funding business ventures.

Arbitrage opportunities

Users can exploit price discrepancies between HCHF and other assets or markets, creating opportunities for profit through arbitrage.

Hedging strategies

By borrowing HCHF against HBAR, users can hedge against potential declines in HBAR's value, protecting their investments.

The value of the collateral (HBAR) is subject to market fluctuations. Significant drops in HBAR's value could lead to increased liquidation events.

The Stability Pool must maintain sufficient liquidity to cover under-collateralized loans. If the pool's resources are depleted, the protocol's stability could be compromised.

Decentralized Finance (DeFi)

DeFi refers to financial services built on blockchain technology, eliminating the need for traditional intermediaries like banks. It allows for peer-to-peer transactions and democratizes access to financial services.

Collateralization

Collateralization involves using assets (in this case, HBAR) as security for a loan. The collateral's value must exceed the loan amount to protect the lender from defaults.

Stablecoins

Stablecoins are cryptocurrencies pegged to stable assets, such as fiat currencies. They offer the benefits of cryptocurrencies (such as fast transactions and low fees) without the volatility.

Liquidation

Liquidation occurs when the value of the collateral falls below a certain threshold, prompting the automatic sale of the collateral to cover the loan. This mechanism ensures the lender recovers the loaned amount.

Redeeming

Redeeming HCHF for HBAR at face value involves risks. The redemption rate can fluctuate significantly, potentially resulting in a loss of your HBAR. For example, large redemptions can drive the fee drastically, sometimes exceeding 20%. Ensure you understand these risks and monitor the current redemption rate before proceeding to avoid unexpected losses.

HCHF stablecoin

HCHF, pegged to the Swiss Franc, serves as the stablecoin used within the HLiquity ecosystem. Its primary function is to provide a stable medium for loans and repayments, mitigating the volatility typically associated with cryptocurrencies.

Incentives and rewards

HLiquity incentivizes participation through various rewards mechanisms. For example, users who deposit HCHF into the Stability Pool earn rewards from liquidation events. These rewards are designed to encourage users to support the system and ensure its stability.

HLiquity and Liquity share several fundamental principles as decentralized lending protocols. Both platforms offer interest-free loans using a native cryptocurrency as collateral—HBAR for HLiquity and ETH for Liquity. Loans are issued in stablecoins pegged to fiat currencies, HCHF for HLiquity and LUSD for Liquity, ensuring minimal volatility. Each protocol requires a minimum collateralization ratio to secure the loans, employs automated liquidation mechanisms to maintain stability, and operates without governance, relying on immutable smart contracts.

While Liquity operates on the Ethereum blockchain, HLiquity utilizes the Hedera network, benefiting from its high throughput and low transaction costs. Both systems also incorporate Stability Pools where users deposit stablecoins to support the ecosystem, earning rewards through liquidation events. These similarities underscore a shared commitment to providing efficient, secure, and decentralized lending solutions.

For more details on Liquity, visit Liquity on IQ Wiki.

HLiquity is a protocol in the DeFi space, offering an innovative solution for borrowing and lending. Its zero-interest loans, stability mechanisms and secure, decentralized framework make it a valuable addition to the Hedera ecosystem. As HLiquity evolves, it has the potential to further provide even greater benefits to its users.

For more detailed information, please refer to the HLiquity Documentation.