1. Smart Contract Security Issues

Smart contract security issues are crucial when it comes to DAOs since these new (on-chain) organizations are built on top of the blockchain technology and rely (almost completely) on smart contracts to function. Generically, smart contracts are self-executing pieces of code that are stored on the blockchain and can be used to facilitate, verify, and enforce the negotiation or performance of a contract. However, because smart contracts are self-executing, they can be vulnerable to a variety of security issues, including errors in the code itself, hacking, and other malicious attacks. Some common security issues with smart contracts include:

Bugs and vulnerabilities in the code: Like any piece of software, smart contracts can contain bugs and vulnerabilities that can be exploited by attackers. These bugs and vulnerabilities can lead to the loss of funds, the unauthorized execution of transactions, or other problems.

Lack of testing and verification: Because smart contracts are often developed quickly and deployed directly to the blockchain, they may not undergo the same level of testing and verification as traditional software. This can increase the likelihood of bugs and vulnerabilities.

Lack of security best practices: Many smart contract developers may not have experience with developing secure code, and may not be familiar with best practices for securing smart contracts. This can make smart contracts more vulnerable to attack.

Lack of regulation: Unlike traditional financial systems, the world of blockchain and smart contracts is largely unregulated. This lack of oversight can make it difficult to hold individuals or organizations accountable for security issues.

Overall, it's important for DAOs to be aware of these security issues and take steps to address them in order to ensure the safety and security of their smart contracts and the funds and assets they manage. This may include implementing security best practices, conducting thorough testing and verification of smart contracts, and working with experienced security professionals to identify and address potential vulnerabilities.

2. Lack of engagement from the DAO community

Active commitment and involvement of the DAO members is absolutely central to the success of this organizational model. The idea of a DAO assumes that members of an organization are driven by tokenomics and some altruistic incentives to get involved in decision-making and help shape all areas. Without an active community and engagement, there is no way for a DAO moderator to get the feedback needed to drive initiatives forward or make decisions collectively in a timely manner.

Depending on how the voting model was defined initially, a certain number (%) of DAO members must cast their votes for a valid decision. However, if the community does not take a long time to vote and thus make a decision, this can also have devastating consequences.

The most obvious risk here would be if an important adjustment proposal, e.g. for improving security (e.g. the governance protocol) does not receive enough voting participation for too long and an adjustment that is important from the security point of view cannot be implemented promptly.

We will write more about the different voting models and their advantages and disadvantages in a future blog post.

As a conclusion to this risk, community engagement is a requirement as well as the main benefit of decentralization and is fundamentally lost if the community is not willing to provide this engagement and involvement.

3. Regulatory Risks

DAOs are still a fairly new concept, and as such, the legal framework for regulating and taxing DAOs is still evolving. Wyoming (USA) has created a framework for DAOs which may be used as an example and foundation for other states and countries to do so as well. Depending on the country or even the region of a country in which a DAO is to be founded, there can be very big differences. In addition, new regulations and provisions for DAOs can also be expected if this form of organization becomes more and more established. You have to be aware of this risk and accordingly the activities and initiatives of the legislation should be continuously monitored and their influence on your own DAO evaluated accordingly.

4. Key Man Risk

The key man risk is the risk that key people or even an entire founding team of a DAO decides to abandon the project due to resentment, disappointment, anger or revenge. This "rug pull" is a nightmare scenario for a DAO, because in many cases the DAO moderation and parts of the governance structure are then completely eliminated. The DAO is left in the lurch and then has to reorganize itself with the remaining members, which in many cases is very difficult or almost impossible. How is the DAO supposed to control and "govern" itself then? How will important new changes to the current protocol standards be proposed and implemented? This risk must already be taken into account during the initial setup of the governance, tokenomics and the voting model.

5. Unilateral decision making through a dominance of governance tokens

The point of a Decentralized Autonomous Organization is to use the wisdom of the crowd. If a DAO issues ERC-20 governance tokens, but a few wallet addresses hold 51% of the voting rights in the protocol's governance, there is a risk that these individuals will collude in a so-called 51% attack. In order to avert this risk or at least greatly reduce it, so-called quadratic voting was developed, in which the wallet address with the lowest number of tokens (shares) receives a disproportionate voting right per token. More about the different voting systems and their advantages and disadvantages will be described in a future blog post.

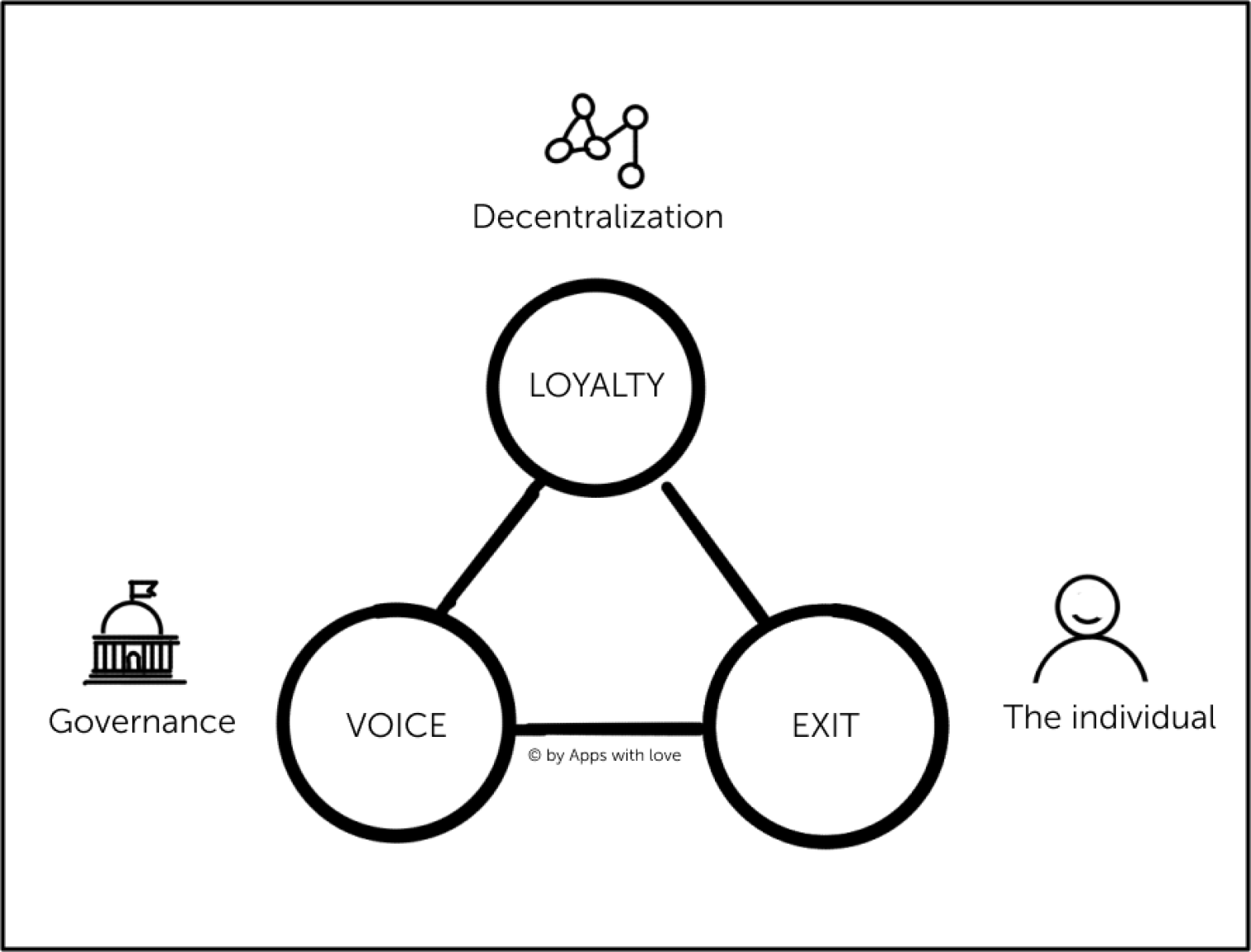

6. Too little thought through governance and too early decentralization

The risks already described clearly show that it is very important to design the governance strategy and the optimal voting system for a project very well, to test it and to consider all possible risks before decentralization takes place. Without a functioning system in place, it is not a good advice to kickstart your DAO.