Tokenomics and Game Theory

Game theory was one of the most exciting topics for me in my economics studies because it is ubiquitous and applied in almost every aspect of life.

Sure, game theory is mostly used consciously in economics, but it plays a central role in tokenomics and cryto projects in particular. By definition, game theory is a branch of mathematics that studies strategies in competitive situations where the outcomes for the players involved depend critically on the actions of the other players.

The basic assumption is that each involved party is independent and makes its decisions after weighing the expected costs and gains of its actions. The big question here is who has what information. The more clarity (transparent rules) and equal amount of information all players have, the better future actions of the parties can be predicted.

So the reason why game theory is ideally suited for the blockchain world is because here, thanks to smart contracts and transparently communicated tokenomics models, the rules in the "game" have been clearly defined and all actors (should) have the same info. This is usually not the case in the real world, which is why those with more and better information can benefit more than everyone else. Research has shown that the better informed party in a deal usually gains up to 18% more economic advantage than the less informed party.

Arguably the most famous figure in the genesis of game theory is the American mathematician John Forbes Nash Jr. According to Wikipedia, Nash was also interested in physics and even recited one of his theories to Albert Einstein when he began studying at Princeton in 1948, but apparently at the end of the conversation Albert Einstein advised him "to study more physics" 🙂

Now, in relation to our topic of tokenomics, the theory of "Nash equilibrium" is probably the most important to understand. The so-called "Nash equilibrium" arises in a situation where no player can benefit from changing their own strategy, provided that all other players also remain true to their strategies.

The famous example of the prisoner's dilemma helps to understand the concept of the Nash equilibrium. Two suspects are interrogated separately for a crime. If both confess, they get four years in prison. If neither confesses, each is sentenced to two years in prison. If only one confesses, he is released and the other is sentenced to six years.

What will happen now? What would you do? Why?

The most important question here is: does everyone have the same information? And therefore: which option will they choose?

The best outcome is that neither confesses. However, the game theory model predicts that both will confess because they have no information about what the other prisoner will do and therefore hedge their bets and both converge on the middle outcome.

Satoshi Nakamoto also indirectly refers to game theory in his bitcoin whitepaper in 2008: "If a greedy attacker is able to assemble more CPU power than all the honest nodes, he would have to choose between using it to defraud people by stealing back their payments, or using it to generate new coins. He ought to find it more profitable to play by the rules, such rules that favor him with more new coins than everyone else combined, than to undermine the system and the validity of his own wealth."

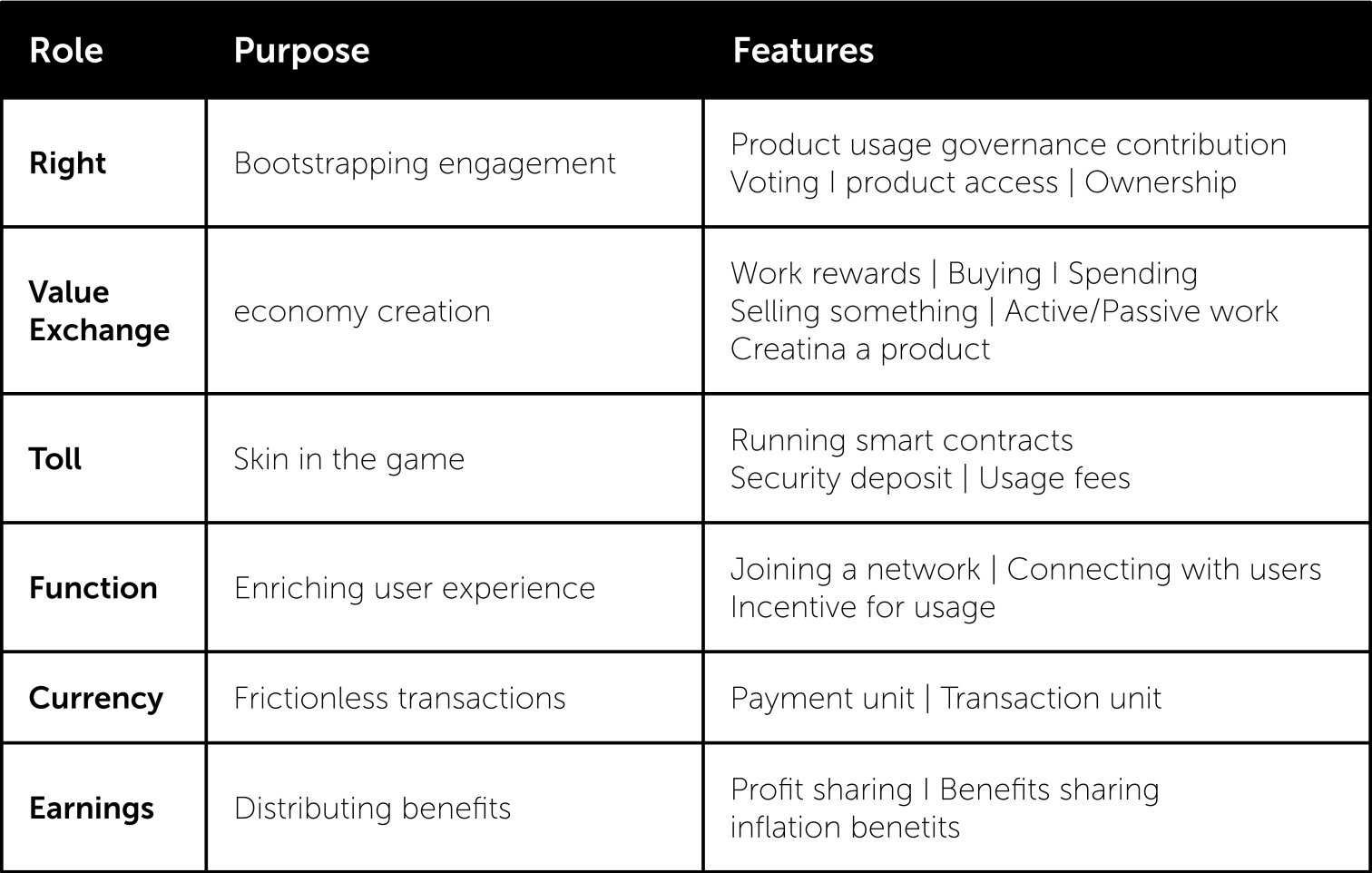

Game theory is a branch of mathematics that studies strategic decision making. Tokenomics is the study of the design and use of tokens within distributed systems. Game theory is often used in the analysis of tokenomics as it helps to understand the strategic behavior of different players within a network and the potential outcomes of different token design choices. For example, game theory can be used to analyze the effects of token issuance, distribution, and incentives on the adoption and growth of a decentralized network. Additionally, tokenomics can also be considered as a form of game theory in practice, as it involves the design of rules and incentives to encourage certain behavior within a network. The goal of tokenomics is to create a balanced and sustainable ecosystem that aligns the interests of different stakeholders within the network and incentivizes them to act in the best interests of the network as a whole.