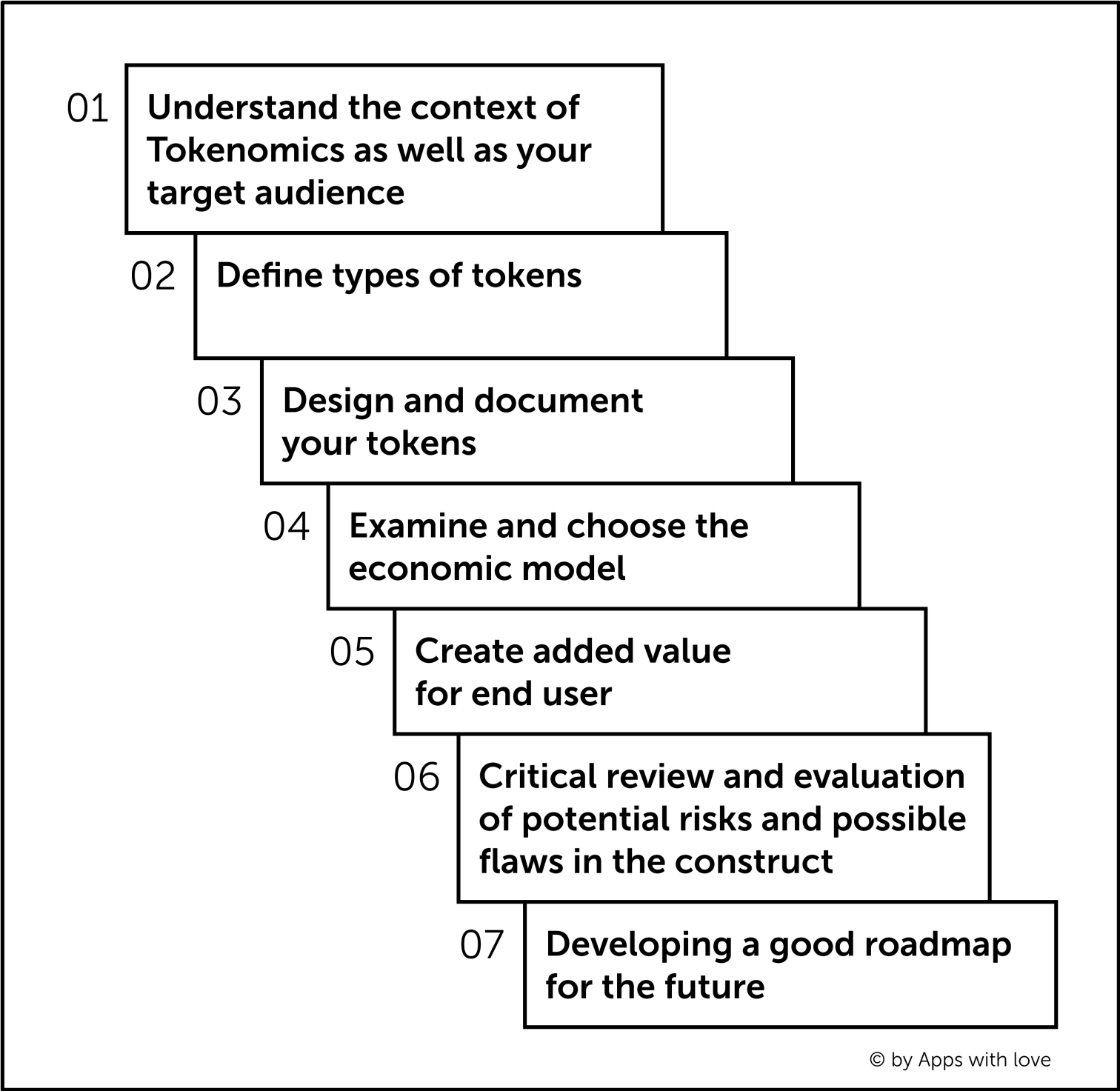

Step 1: Understand the context of Tokenomics as well as your target audience

blokk. embraces the idea and methodology of design thinking. During the last decade of custom software development projects we learned, that it is absolutely important to know the context and understand the user's needs before starting with concept work. We often use the chinese saying: “If you want to be fast, go slowly”. This is also the case when defining the tokenomics of a blockchain project. If you move too fast without the necessary knowhow, time to revise and iterate, you will most probably get in trouble later on. It will take much more time to solve the problem later on than if you do your research on the topic, the options and basic factors to understand token mechanics before you start.

So, the first step is to really understand tokenomics, to understand the target market and target audience. Without this knowhow you most probably fail to define the right token models and especially you won't be able to create the right incentives and long term values needed to implement a sustainable and successful tokenomics model. Of course, blokk is here to help if you wish to get external help for this important first and also for the following steps. But even if you engage with us or with any other agency specialized in the field of blockchain it is very advisable to make your own research and never stop asking you and your partners the right questions.